For those who have kept educational funding funds from things such as pupil finance, you need to use it currency on the almost every other studies-associated expenses. Be aware that new Irs often income tax which money as money.

Multiple Funding Sources

Annually, you need to complete and you can complete new Totally free Software for Government Beginner Services (FAFSA). This permits the federal government, your state government, and your school to find the installment long rerm loans no credit check Richmond IN apps in which you are qualified. The university will send you factual statements about the fresh new types of educational funding you could potentially incorporate to your the university fees or other training costs.

Very pupils combine sources of educational funding to fund the school can cost you, but if you receive adequate money from need-mainly based grants and you may merit-built scholarships and grants, it’s not necessary to get college loans. Actually, you may also rating enough award currency which you have leftover financial aid.

What will happen unless you play with any educational funding currency? What in the event that you perform having kept school funding awards?

How come Financial aid Functions and you can Let’s say I get a Refund?

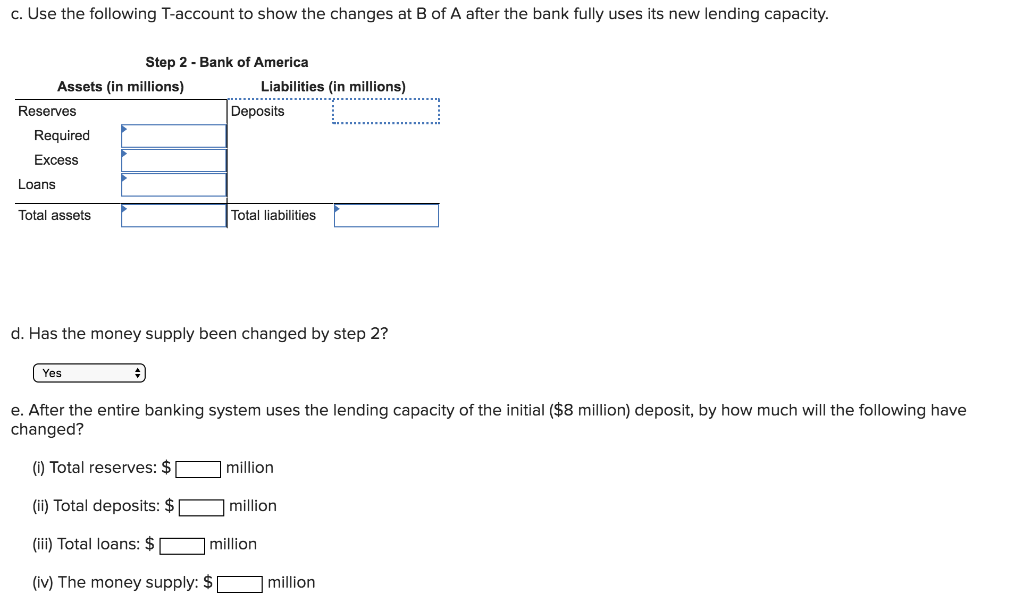

Financial aid cash is approved by college so you can youngsters just who meet the requirements, but your school may apply their tuition and related costs on the school funding matter you really have. As a result you will not located a seek out the fresh new total number of debt assistance.

As an alternative, the institution use exactly what it needs to shelter your personal expenses regarding your own training. If you reside toward campus, the university might deduct the price of their dorm otherwise apartment out of your financial aid.

- Books

- Laptops

- Research products otherwise charge

- Certain products, such as a specific types of shoe required for a class

- Almost every other material, such as for instance notebook computers

Talking about thought training expenditures, but not, so you should fool around with school funding to pay for such will cost you. When you take aside financial aid such student education loans to pay for such can cost you, their university must disburse it profit a good number of date before the semester initiate. Whenever they do not, government entities requires them to help you find one other way to cover those people costs since they’re degree-associated costs.

When your college costs is actually protected, you are permitted a reimbursement. You certainly will located that it refund a short time just after the latest semester starts. Universities want to make certain all their expenditures try covered prior to they spreading money.

- Get-off the other money in an account along with your school.

- Have the money just like the a primary deposit into the checking account, if you have a personal checking or family savings thanks to a prominent lender together with your college or university.

- Ask for a, which you are able to get otherwise has actually mailed for the most recent address.

Universities will wait until about a short time following add/withdraw big date, so they know the way of several groups you are taking and certainly will influence their tuition amount. For those who withdraw out-of categories otherwise is actually late adding kinds, this can apply at once you located your financial aid award glance at.

Particular grants or scholarships may not let you apply loans to help you the cost of living, so check the regards to your financial assistance prizes to make certain your qualify. If you don’t have fun with your entire educational funding award money, you have options about how exactly it is invested.

What goes on basically Didn’t Play with Every one of My Educational funding Money?

Once the school funding is intended to defense your own degree expenditures, schools anticipate youngsters to utilize as much as they must pay for lead and you can indirect costs. Once you discover an overage evaluate from your own school funding, the inner Funds Solution (IRS) could possibly get amount this given that money, you would have to document taxes. This money might apply at your FAFSA guidance.

Once you discover a refund search for school funding overage, you ought to fill in information on your fees towards Internal revenue service, like:

- Amounts used for incidental costs, together with way of life regarding university, travelling, and you will elective gadgets (things not necessary for your coursework)

- Wide variety gotten because the repayments for your functions, particularly practise, plus currency provided by way of some graduate fellowship apps

Their college will send you a taxation acknowledgment about how to file the shape 1040 at the end of the season. Even if you don’t make use of this currency and now have it during the a checking account, it is believed money of the Internal revenue service so you need to file it rightly.

What if We Take out Alot more Mortgage Money Than I wanted?

You will be able which you miscalculated their expenses toward seasons and you may requested more funds into the student education loans than simply you really you would like. Your own college often however give you a refund register that it case, but remember that the money you receive continues to be lent currency. You will accrue interest inside, and you will need to pay back one dominant amount.

When you are scholarship and you will grant money is 100 % free money, college loans commonly. For those who have high-living expenses, you can make use of the education loan refund to fund people can cost you. Yet not, for those who have the bills secure and do not you need the newest refund evaluate, you really need to get back so it currency. In that way, that you do not shell out accruing focus along side 2nd 10 or a whole lot more decades into money you probably did not need.

It is possible to turn-down currency you don’t have. Such as for example, while qualified to receive the fresh new Pell Give, a quality-based academic scholarship, subsidized college loans, and unsubsidized college loans, its not necessary to simply accept most of these types of school funding. In the event your Pell Give and the merit-built scholarship safeguards your circumstances, you certainly do not need to acquire any cash.

If you like a student loan, request a price which covers their leftover training will cost you. Believe if you have the time for you to rating a member-day business to cover your bills.

Fool around with Financial aid Refunds to remain Financially Steady

You should exercise financial duty having any financial aid refunds. Make sure you know what goes otherwise explore the of one’s educational funding prize currency, so you can generate an excellent decisions on and this expenses to fund.