Money spent Financing Additionally the Issue Regarding Getting one

A residential property also have an effective opportunity for capital for those who know very well what you are doing. Also brief buyers made a clean funds away from turning home or leasing out qualities. Although not, just because you invest currency for the a home does not always mean one to you’ll immediately earn profits. In fact, for this reason securing an investment property financing should be harder than you might envision.

What exactly is A residential property?

A residential property is certainly one which you buy as a means to generate income. It is far from a primary quarters, second household, or trips domestic. Including, of a lot small investors often purchase belongings that want work over towards them. He is underrated from the resolve work and you can recovery works that you need to acquire her or him for the good shape. Investors remember that to make those people solutions and renovations may help bring the value up. Afterward, our house will be flipped back on the market for a good profit. Home turning is a preliminary-title property funding approach. A a lot of time-identity approach could be to acquire property and leasing it because possessions continues to delight in inside the value, allowing you to improve rent as well as your payouts historically.

What’s A residential property Mortgage?

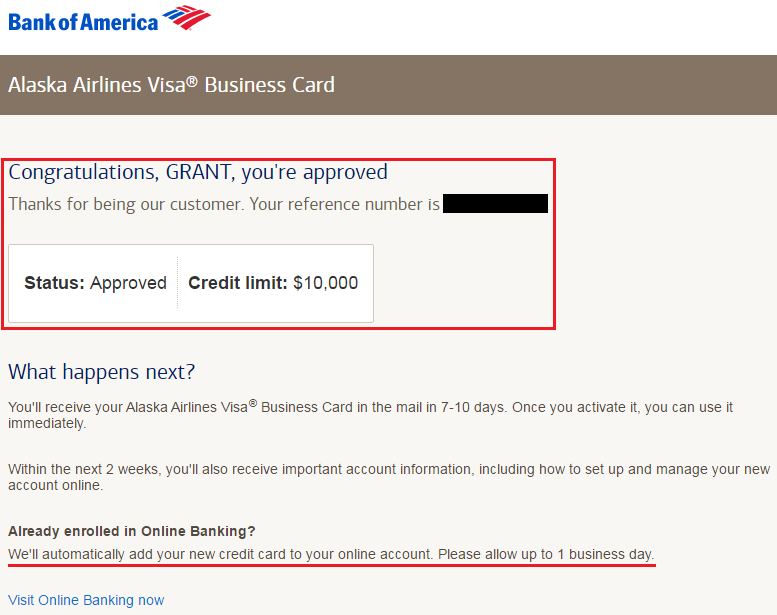

If you are searching to buy a property, whether it is so you’re able to flip it across the brief otherwise lease it along side long haul, you will most certainly need to use out a loan and that means you can afford the acquisition. But not, loan providers thought investment attributes becoming a particularly high risk. Capital services dont constantly exercise, while the borrower ount away from financial obligation they’ve taken upparticularly if they are still paying the loan on the number 1 house. As a result, investment property funds are far more difficult to qualify for, tend to be more expensive to pull out, and you will tend to have less advantageous terms.

Kind of Loan Is best for An investment property?

As the difficult as it might become so you can qualify for a financial investment possessions financing, you really need to still think about it if you have found a residential property that you think could be such as for example rewarding. Here are the different varieties of investment property fund you will want to look into should this be the fact:

Traditional Mortgages

Obtaining a normal investment property loan away from an exclusive lender have a tendency to need you to possess a credit history of at least 720, although this matter is actually flexible according to other factors (such as your personal debt-to-income ratio and you will credit rating). You will need to make at the very least a 20 percent off commission as well, and you will expect the interest to be between one to 3 percent higher than that a classic mortgage. Charge would be large due to the Federal national mortgage association risk-created rates modifications, which is an extra 0.75 %. The fresh new LTV must be 80 % or shorter https://paydayloanalabama.com/gulfcrest/. Finally, some lenders will need which you have drinking water supplies off upwards so you can 6 months.

Know that for those who have five mortgages towards term, you are able to don’t have the ability to pull out a conventional capital assets mortgage. You would need to read another system established from the Fannie mae, that allows buyers for ranging from five and you may ten mortgages to the identity. In order to qualify, you will have to build a 25 % down-payment toward single-relatives home otherwise a 30 percent downpayment if it’s a great two to four-equipment assets. When you have six or more mortgage loans, you will need the very least credit score out of 720.