As well as credit money for the acquisition of a prepared-to-move-in-house or for booking an around-framework possessions, you may also avail of home loans discover a property constructed on a land. Particularly financing are generally known as framework funds and therefore are provided by the all the top loan providers within the India.

Be also conscious of the point that house framework money was different from mortgage brokers and you can area loans. Except that the different prices, these around three sorts of fund also provide differing small print. Additionally there is a difference regarding the installment period.

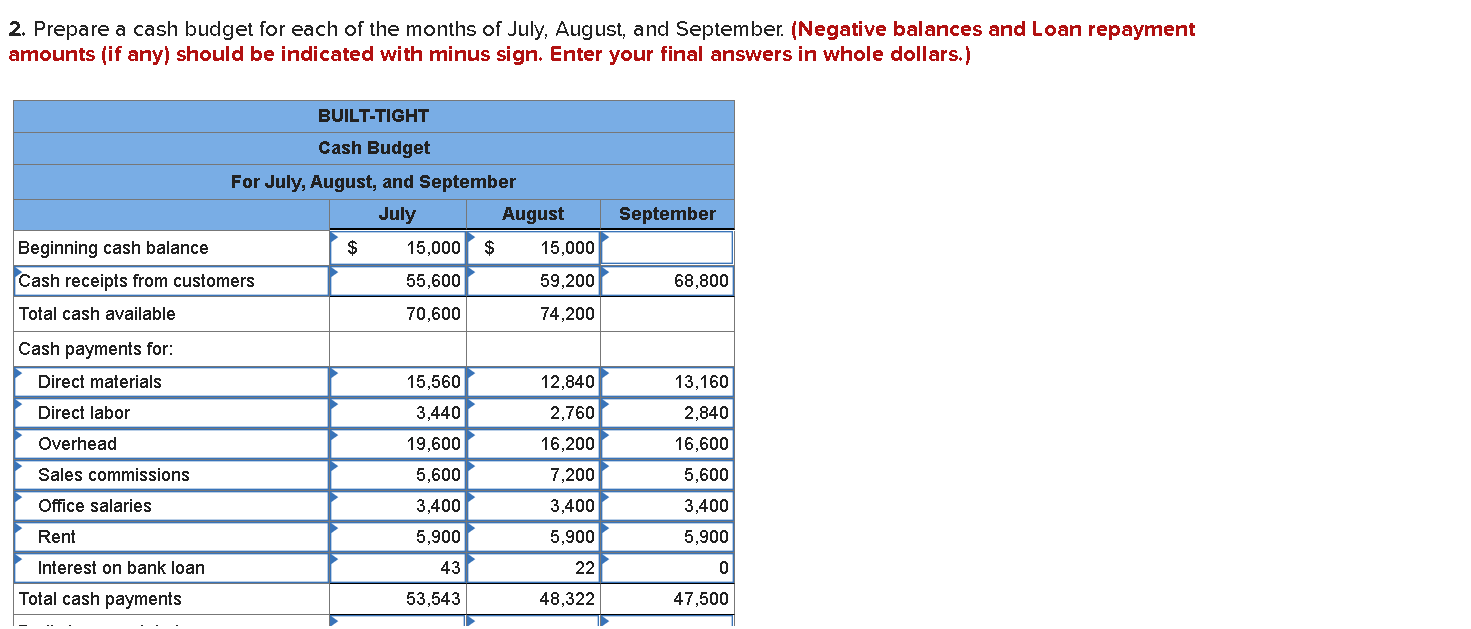

The procedure of acceptance and you can disbursement regarding a property mortgage are a bit different from that a regular housing loan.

Home structure mortgage: Qualifications standards

- Age: 18 age to 65 ages.

- Domestic standing: Must be a keen Indian otherwise low-citizen Indian (NRI).

- Employment: Self-employed and you may salaried individuals.

- Credit history: Over 750.

- Income: Minimum income away from Rs twenty-five,one hundred thousand 30 days.

Data requisite

Along with the typical learn your own customer’ (KYC) and income records, so you’re able to take advantage of home financing to possess constructing a home towards the a block of land belonging to your, you will need to deliver the prospective bank utilizing the associated files you to expose the term and you may possession of patch of your own home. The new parcel can either be a tenure property / plot, otherwise it could be allotted from the one invention expert, such as CIDCO, DDA, etc. You may avail of financing into a good leasehold house, the spot where the lease is actually for an extremely long time. Then there are add a no- encumbrance certification in regards to the house or property.

Plus the files of the area, you will need to fill in the program and build of recommended house, duly authorized by the local civil authority otherwise gram panchayat. Then there are add a price of cost off framework, which has been formal from the a civil professional otherwise a designer. Considering these files, if for example the financial are came across concerning your complete eligibility additionally the imagine of costs filed by you, it will sanction our home financing at the mercy of the usual terms and conditions and you may standards.

Margin money

Just paydayloancolorado.net/yampa/ like any other mortgage, the newest debtor would have to lead the margin currency towards the framework of the property, with regards to the number of financial that’s expected. Whenever you are figuring their share, the cost of the new plot is even considered, whether your exact same has been bought has just. However, the importance/price of the brand new spot is not considered when you’re computing the contribution, should your same might have been handed down by the or is acquired due to the fact a gift or if it had been bought much time right back.

Disbursement of one’s mortgage

The brand new disbursement of your structure loan is accomplished inside pieces, in addition to cash is create, in line with the improvements of the build, similar to the procedure followed whenever an around-build flat try kepted having a developer. Although not, the lending company does not disburse any money right up until your bring in your contribution due to the fact decided and gives evidence of a similar. To have choosing disbursements regarding financial, you will have to complete photos of the home and you can certificates out of a designer or municipal engineer regarding the stage out of completion of the property.

The financial institution get have confidence in this new certificate and you can photo registered from the you, or this may decide to depute a unique technology person to make certain the same. Thus, when your structure is performed rapidly, the fresh new disbursement of cash from the bank may also be quicker.