Access to financial is very important to possess setting up good economic models and steering clear of the high costs usually for the alternative economic properties. If you are starting a checking account try apparently simple, it can establish a problem getting immigrants, including people who find themselves not used to the usa and also have restricted English proficiency, together with individuals who go into the nation as opposed to papers.

With each other, there are forty-two.9 mil immigrants from the U.S., 10.3 million off whom is undocumented. Information financial legal rights can also be ensure that immigrants have the ability to availability new financial services and products they need.

Key Takeaways

- There are an estimated forty two.nine billion immigrants in the us, along with 10.3 billion undocumented immigrants.

- Of several immigrants may well not discover the banking liberties or just how to unlock a checking account, particularly if they lack the needed documentation to do this.

- Vocabulary barriers may also inhibit immigrants regarding looking for this new financial services they have to best do their money.

- Becoming unaware of their banking legal rights could easily rates immigrants hundreds if not several thousand dollars within the way too many fees.

Bank account https://elitecashadvance.com/loans/2500-dollar-payday-loan/ and you can Immigration Standing

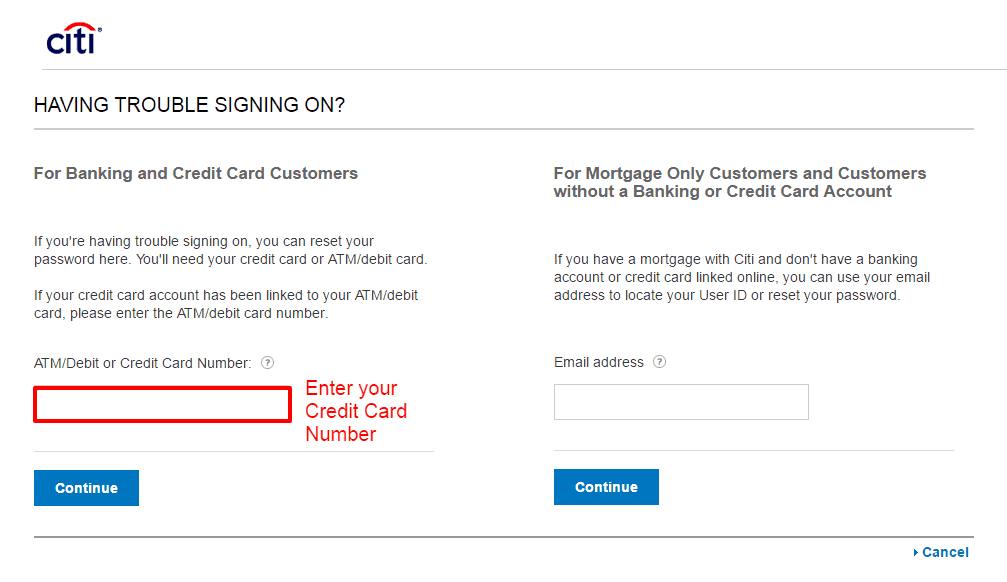

Probably one of the most aren’t asked issues you to definitely immigrants could have is whether you can discover a bank checking account in place of a good Public Security amount. The brief response is sure, it’s possible to get a bank checking account in place of a personal Security number if you’re able to provide other forms of help paperwork otherwise identity. The common pointers you to banking institutions need certainly to discover a different account tend to be their:

- Title

- Time away from delivery

- Target

- Identification

Rather than a social Coverage number, you will be able for immigrants to open up a checking account having fun with an Personal Taxpayer Personality Number (ITIN). So it amount, given from the Internal revenue service (IRS), is made for people that lack and generally are perhaps not eligible for a personal Coverage matter. ITINs are issued no matter immigration status and will be used to open up a checking account.

A keen ITIN doesn’t authorize you to are employed in brand new You.S., neither does it provide qualification to own Personal Protection positives or be considered a centered having Acquired Tax Borrowing from the bank (EITC) objectives.

- Good nonresident alien that has needed to file an excellent You.S. income tax return

Credit cards and you may Finance to own Immigrants

Providing credit cards or loan will help to see financial demands and can end up being ways to expose and construct an excellent U.S. credit history. Immigrants have the right to apply for loans and you will handmade cards, and you may a number of financial institutions and you may lenders promote him or her. You can find, yet not, some constraints and you may conditions.

Such as for instance, Deferred Action to possess Young people Arrivals (DACA) readers is actually ineligible to possess federal student loan software. However, capable to find individual college loans from banking companies or any other lenders, and personal loans otherwise auto loans. Meanwhile, most other noncitizens could possibly effectively submit an application for government beginner money if they can give sufficient files.

Specific Local American people produced when you look at the Canada which have a position less than the new Jay Pact away from 1789 may also be eligible for federal beginner assistance.

Certification to possess personal college loans, unsecured loans, auto loans, or mortgages can vary out-of bank to help you lender. Particularly, zero verification out of citizenship otherwise immigration updates may be needed if the the applying also provide an ITIN and you may proof of income. A great passport or other character can also be requested to-do the borrowed funds application.

In terms of handmade cards go, a great amount of economic tech (fintech) organizations allow us borrowing from the bank items particularly for individuals who do not have a social Protection count. People may use an ITIN instead to get accepted. If they’re in a position to unlock a free account, they could after that play with that to determine and construct a card records, which could make they better to be eligible for financing.

Majority try a cellular banking software customized for immigrants that is sold with personalized the means to access banking and no overdraft charge or international purchase charge.

Mortgages to own Immigrants

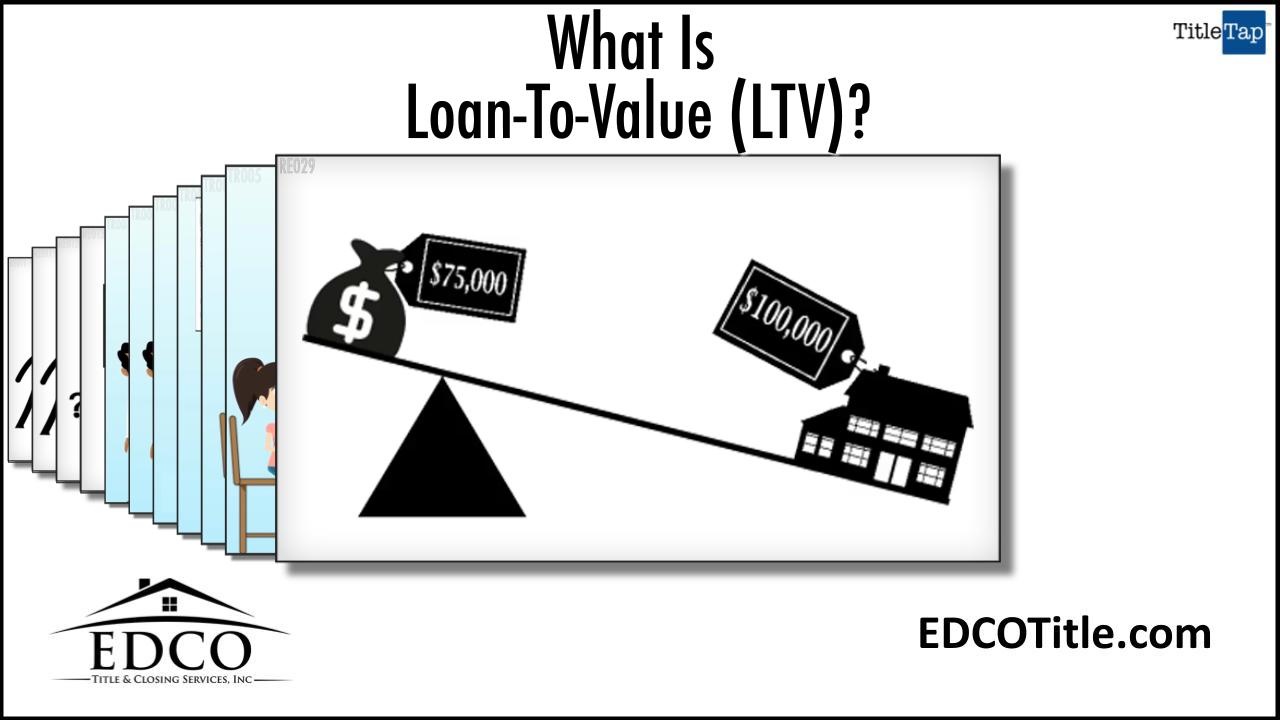

To order property typically setting bringing a home loan, and you can immigrants have the straight to submit an application for a mortgage on You.S. The most significant issue with taking recognized is capable satisfy this new lender’s degree requirements pertaining to employment background, credit rating, and you may proof earnings. If you don’t have a credit score in the U.S., as an instance, that may make it more challenging to have lenders to evaluate their creditworthiness.

Beginning a bank account that have an international lender who may have U.S. branches otherwise with a great You.S. financial can assist you to present a monetary history. Once more, you could open a bank checking account having a keen ITIN, plus lender may will let you submit an application for a home loan using your ITIN as well. Looking around evaluate financial alternatives makes it possible to get a hold of a bank which is willing to work with you.

Giving a more impressive downpayment make it more straightforward to be considered getting a home loan from the U.S. when you yourself have immigrant condition.

Sure, you can legally unlock a bank account even in the event you have a personal Cover matter and you may regardless of your immigration condition. A good amount of finance companies and you may borrowing from the bank unions take on a number of off identification data, and one Taxpayer Personality Count (ITIN), to open up a checking account.

What exactly is an ITIN?

The inner Cash Solution (IRS) activities ITINs to the people who’re expected to file tax statements and therefore are not entitled to score a social Security count. This new ITIN may be used instead of a personal Shelter matter whenever beginning a new family savings or applying for certain finance and you may credit cards.

Perform I want to reveal immigration documentation to open a lender account?

No. Finance companies and you may borrowing unions ought not to ask you to show your immigration standing to open a bank account. If you feel you to definitely a financial or another lender is discriminating facing your centered on the immigration reputation, you can document a problem through the Federal Put aside Bodies User Grievance function on the internet.

Normally unlawful immigrants keeps a bank account?

Yes, undocumented immigrants for the All of us have the right to unlock a checking account. Once again, banking institutions must not require you to establish the immigration position in order to open an account.