Homeownership is one of the premier resources of wealth for Americans. In the event your house’s worthy of rises and you afford the home loan promptly, the possession show expands, turning it into a veritable piggy bank.

Because loans Oneonta AL of the run up in home rates during the pandemic, You.S. home owners gain access to extra money within their homes than ever before just before. At the beginning of 2022, an average resident got $207,100 inside the tappable guarantee, centered on financial-studies enterprise Black colored Knight .

Domestic security financing are a good way you might remove dollars off your property. Here’s how the fresh money performs, how to buy one to-plus the risks of on a single.

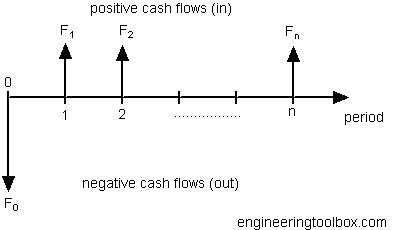

Just how a home equity financing work

House guarantee ‘s the difference between the value of your property plus the amount you borrowed on your own home loan. Normally your equity is certainly going upwards every time you build a beneficial payment. In the event that home prices rise, you’re going to get an additional increase. Visualize an old-fashioned scale-when you purchase a property, you actually have more debt than just collateral, so the scale try lopsided with the loans. However, per mortgage repayment adds weight with the equity container, tipping the dimensions over the years.

Domestic security financing, also known as next mortgages, is actually an alternative to playing with handmade cards otherwise signature loans so you can consolidate obligations, loans a massive get otherwise deal with a monetary crisis. You’re however trying out financial obligation, but will at the a diminished interest rate than others other procedures. That is from inside the large area while the financing was covered by the household, which the bank usually takes if you cannot pay back exactly what you borrowed. That have credit cards, the results- and quicker borrowing availability, later fees, and you will mounting notice-are not just like the serious.

While approved to own a home security financing, you earn a lump sum payment that one may purchase you need. Then you are guilty of monthly payments of dominating and you may notice, in addition to the majority of your home loan repayments.

Inside the an emerging housing industry, states Eric Alexander, a financial advisor during the Standard Money Category inside the Dallas, the value of your residence continues to increase as you pay your self back. Your residence does not have any tip discover that loan against they, he says-definition the mortgage wouldn’t affect what you can do to construct money. You to definitely, if you ask me, is actually a confident.

But exactly how far dollars can you step out of your property? Basic you need to see how far guarantee you have.

How exactly to be eligible for a property guarantee loan

You want an assessment in order to be eligible for a house guarantee financing, you don’t have to just go and purchase $500 so you can $750 employing an enthusiastic appraiser your self, says Robert Heck, vp of home loan in the Morty , an on-line mortgage broker. Really loan providers need to perform an assessment in-house, according to him, to make certain that action will in all probability come once you’ve picked a lender.

If you prefer an offer of just how much your property is value before you apply for a house collateral financing, fool around with free online systems from real estate areas instance Zillow otherwise Redfin, or verify that the majority of your home loan company may help. Some lenders now have this type of systems open to consumers early in the act, Heck states. As well as will most likely not charge because of it.

State your current family well worth is $five-hundred,one hundred thousand as well as your remaining home loan balance try $two hundred,one hundred thousand. New part of the household you outright own-their security-was $3 hundred,one hundred thousand. This means that, you may have sixty% equity; another forty% is actually owned by the economic enterprise one holds their home loan.

Lenders generally speaking wanted family security mortgage consumers to maintain at the least 20% collateral. Which means you could potentially acquire around 80% of your own latest home well worth involving the current home loan equilibrium and you will your new loan. Here is the algorithm, making use of the amounts in the analogy over: