Knowledge Family EquityHome collateral ‘s the percentage of your home that you actually own. Its computed because of the deducting any a good mortgage equilibrium throughout the most recent ple, in the event the house is really worth $eight hundred,000 therefore are obligated to pay $250,000 on the mortgage, your home guarantee try $150,000. This guarantee should be an asset with regards to a home opportunities.

Cash-Out Refinance: This one concerns refinancing your home loan getting increased amount than simply you already owe. The essential difference between the brand new home loan and your established home loan is given to your just like the cash, which can upcoming be used to buy a rental assets.

Domestic Collateral Loan: Just like an effective HELOC, a house collateral loan allows you to borrow secured on your home guarantee

Enhanced To shop for Energy: By tapping into your residence guarantee, you could raise your to shop for fuel and you can manage a more beneficial rental possessions than you can with only finances offers.

Prospect of Enhanced Cash flow: For individuals who and acquire accommodations property one generates positive earnings, the funds can help safeguards the home loan repayments, property administration charges, and other costs associated with property ownership.

Leverage: A property is frequently noticed a beneficial leveraged resource. That with borrowed money to find property, you can enhance your possible yields if your possessions appreciates within the value.

The fresh Cons and you can RisksWhile you will find obvious advantages to using family collateral for resource intentions, it is very important to acknowledge the dangers inside it:

Industry Fluctuations: Areas might be erratic. In the event that property opinions decline, you may find oneself in a position for which you owe a whole lot more compared to house is value.

Enhanced Obligations: Playing with home collateral develops your debt weight. When the rental income does not shelter the expenditures, you may face monetary filters.

Price of Borrowing: Family guarantee financing and HELOCs normally come with rates of interest and you may settlement costs. It is essential to comprehend the a lot of time-identity cost of borrowing just before continuing.

Death of House: If you cannot generate money on your own family equity financing or HELOC, you risk property foreclosure on your first quarters.

Do your homework: Understand the local housing market. Get acquainted with manner, rental productivity, and you may possible admiration https://paydayloancolorado.net/columbine/ prices. Experience with the business allows you to make informed behavior.

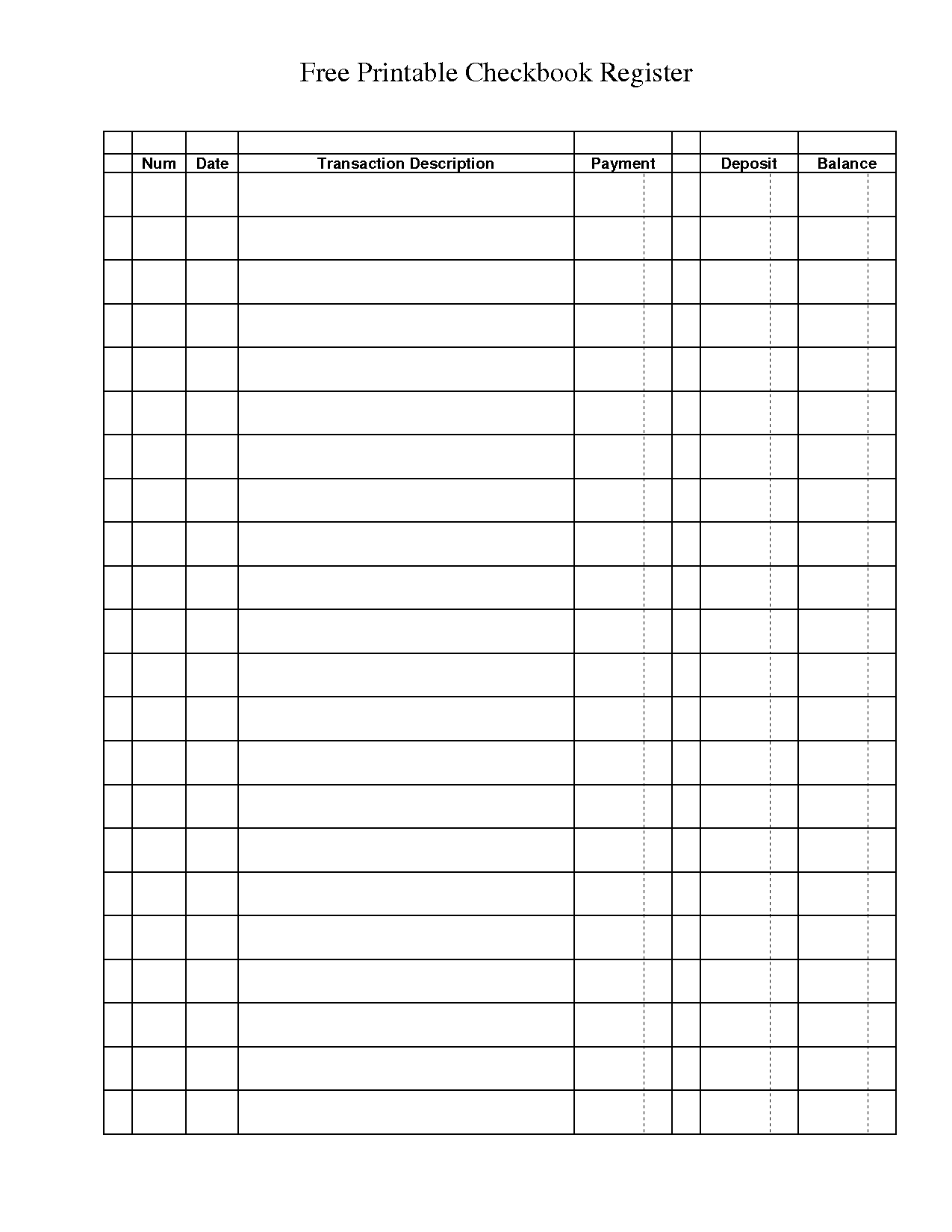

Assess Your Wide variety: Prior to a buy, make certain you create an extensive cash flow study. This consists of estimating possible leasing earnings, bookkeeping to have vacancies, and you may factoring when you look at the maintenance and you can management can cost you. Play with spreadsheets to get ready and you can picture your data.

Believe Location: The spot of your own local rental assets is also significantly impact the earnings. Discover components that have strong leasing consult, a beneficial universities, and you may features.

Specialized help: Envision seeing realtors, like representatives otherwise monetary advisors, that will bring information towards most useful strategies for leverage domestic equity.

Instance StudiesTo then illustrate the utilization of home equity in genuine home financial support, why don’t we consider one or two hypothetical case degree.

It functions particularly credit cards, where you are able to withdraw fund as required, and also you pay only attention to the count your borrow

Case study step one: The latest Winning InvestorJohn, a resident that have $100,000 for the collateral, chooses to remove a great HELOC. He uses so it to purchase good duplex in the a premier-consult leasing field. The house or property creates $3,000 when you look at the month-to-month rent, when you are their home loan and you will expenditures complete $2,000. This plan not merely brings your that have an optimistic cashflow of $1,000 but also lets your to build wide range since the possessions values through the years.

Example dos: The fresh new Cautionary TaleLisa as well as taps toward their unique home equity, however, she sales a home when you look at the a declining people. After a few months, she struggles to come across tenants, if in case she does, the new rental money is shortage of to pay for their particular expenditures. Fundamentally, Lisa is unable to maintain their unique home loan repayments towards each other characteristics and you will confronts the possibility of foreclosures.

ConclusionUsing home collateral to find local rental services will likely be an effective solution to construct your resource profile and you can go financial independence. Although not, it is essential to means this strategy having warning. By carrying out comprehensive research, knowing the threats, and using their smart financial strategies, you can effectively control your residence guarantee getting effective a house investment.